The relevant provisions are found in regulations 3 4 and 6 of the Employment Termination and Lay-off Benefits Regulations 1990. These provisions are only applicable to employees coming within the purview of the Employment Act 1955 eg.

Employee Orientation Checklist Template New Employee Orientation Onboarding New Employees Checklist Template

10 days wages for every year of employment.

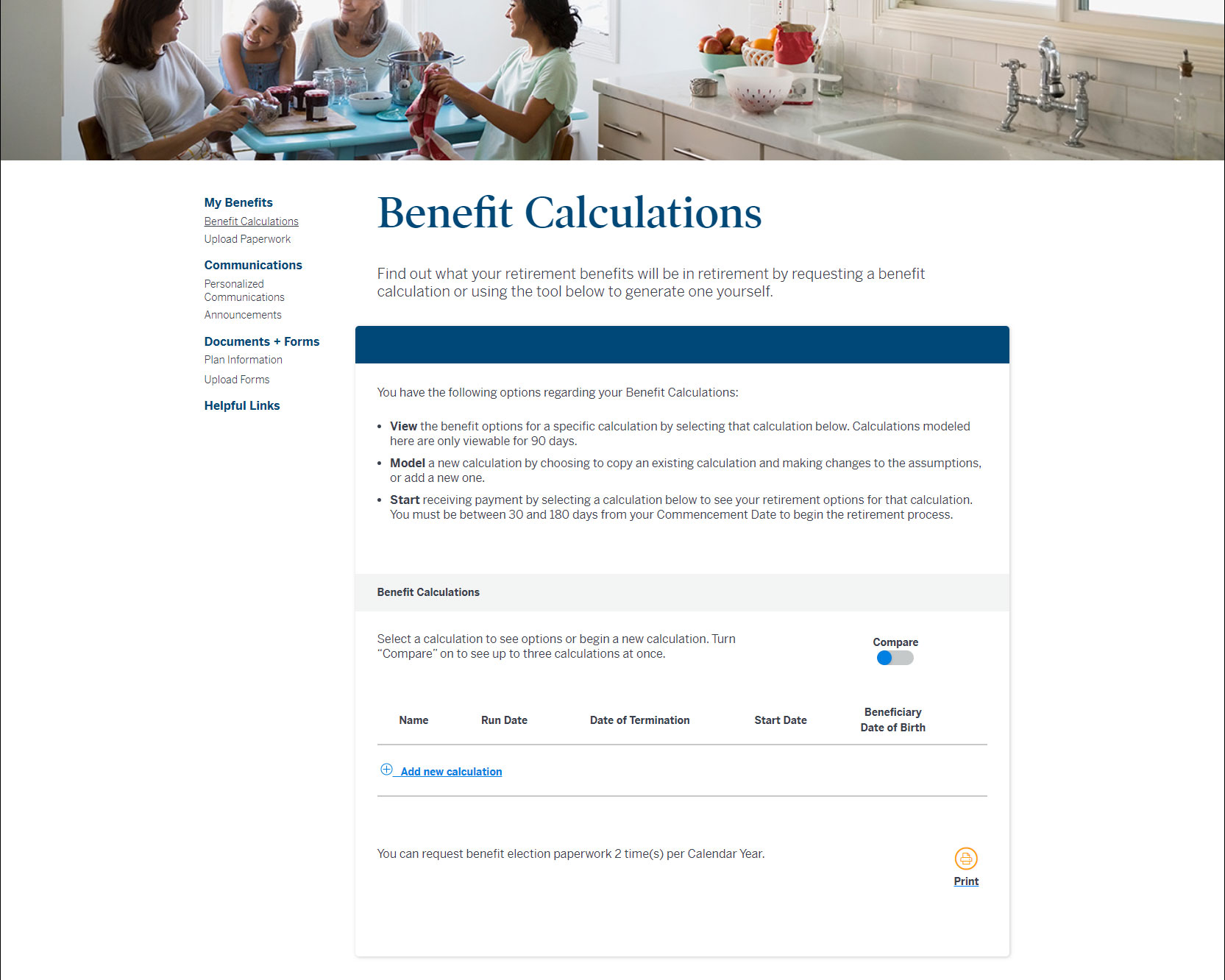

. 10 days wages for every year of employment. The employer shall not pay any such money except with the permission of the IRBM to or for the benefit of the employee until 90 days after the receipt by the IRBM of the form. 1 Any termination or lay-off benefits payment payable under these Regulations shall be paid by the employer to the employee not later than seven days after the relevant date.

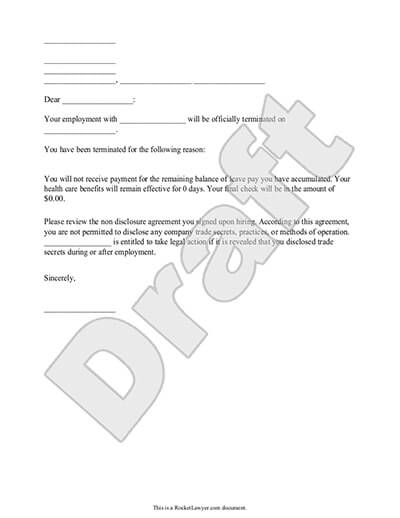

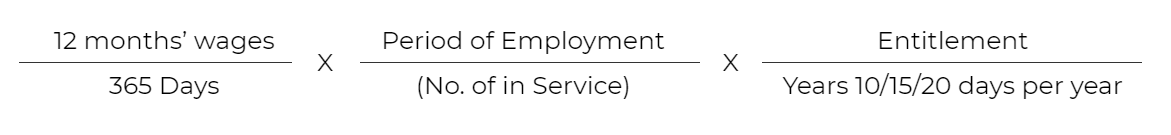

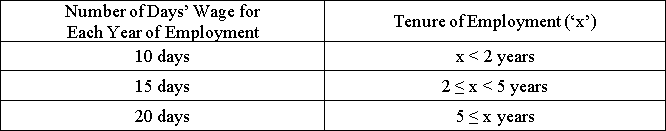

The Employment Termination and Lay-Off Benefits Regulations 1980 sets out the formula to calculate termination or layoff benefits payment which shall not be less than a ten days wages for every year of employment under a continuous contract of service with the employer if he has been employed by that employer for a period of less than two years. Either party has the option of waiving the right to the requisite notice. Termination before July 1 2008 exemption of RM6000 for every completed year of service with the same employer or with companies in the same group.

An additional administrative consideration is the retrenchment benefits to be paid out to affected employees. From the definition redundancy situation happens due to several reasons such as corporate restructuring a decrease in production mergers changes in technology acquisitions. 20 days wages for every year of employment.

The Employment Act 1955 and the Employment Termination and Lay-Off Benefits Regulations 1980 govern the retrenchment procedures of employees who earn not more than RM2000 monthly and manual workers irrespective of the number of their monthly salaries. 15 days wages for every year of employment if he or she has been employed for a. The employer is required to withhold any monies payable to an employee who is about to leave Malaysia for a period of more than 3 months with no intention of returning.

RM10000 for every completed year of service ie. This is applicable if they are employed under. RM20000 for every completed year of service ie.

The amount to be paid is as follows. 20 days wages for every year of employment. 15 days wages for every year of employment.

It still covers the pension funds but now employees can withdraw their savings for specific purposes like house ownership and medical purposes. 12 months This amount is only applicable for loss of employment occurred in 2020 and 2021. The termination benefits payable are as follows or the amount in the employment contract if it is higher.

2A Notwithstanding subsection 2 upon the termination of an employees contract of service the employee shall be entitled to take before such termination takes place the paid annual leave due to be taken in the year in which the termination takes place in respect of the twelve months of service preceding the year in which the termination takes place and in addition the leave. Termination on or after 1 July 2008. Employees whose salary do not exceed RM2000 a month or who are engaged in manual labour.

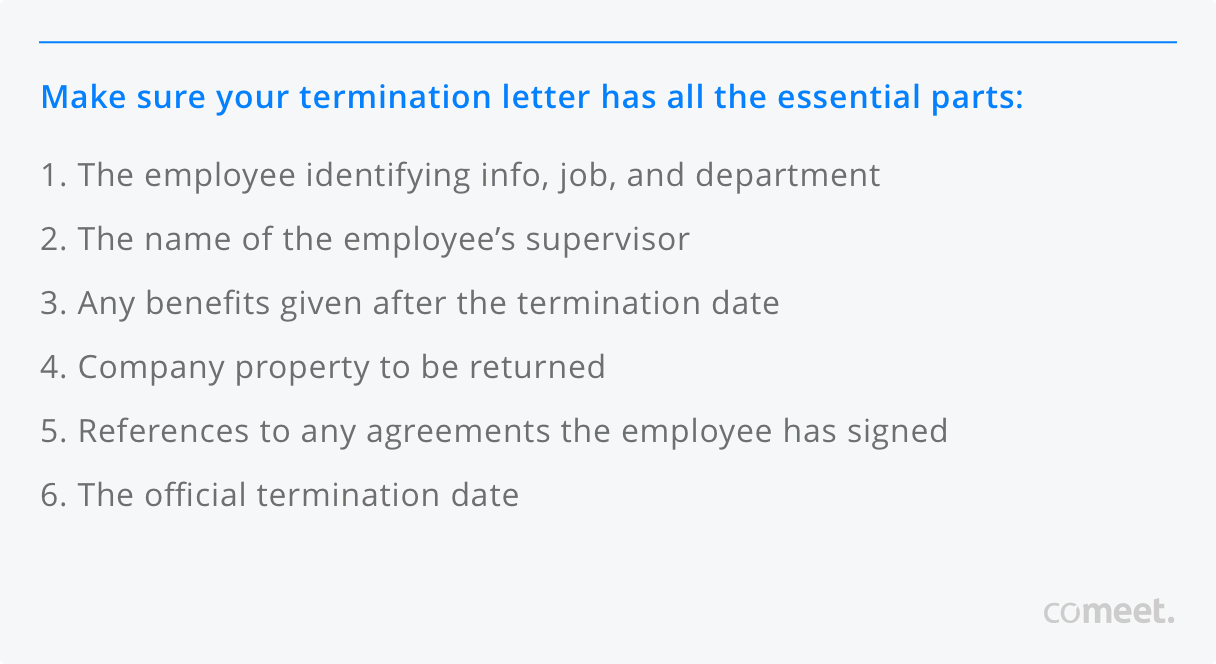

According to the employment contract terms an employer must offer sufficient notice of termination to its employees. However for employees covered by the EA an employer is required to provide employees with a minimum notice of termination as defined in the EA before the day of retrenchment. Less than 2 years.

Two years or more but less than five years. Five years or more. 15 days wages for every year of employment.

The additional administrative considerations are retrenchment benefits. Employees Provident Fund EPF. This exemption was increased to RM20000.

10 days wages for every year of employment if he or she has been employed for a period of less than two years. Termination on or after July 1 2008 exemption of RM10000 for every completed year of service with the same employer or with companies in the same group. 10 days wages for every year of employment if he has been employed for less than two years.

Any transfer of employees in such transactions is effected by a termination by the seller and rehire by the buyer and the seller will be exempted from paying any statutory severance payment under the Employment Termination and Lay-Off Benefits Regulations 1980 if the new offer from the buyer is under terms and conditions of employment not less. All employers and employees except foreign workers must contribute to EPF at the. More than 2 years but less than 5 years.

EPF is a social security institution aimed at providing retirement benefits to Malaysian workers. 2 Any employer who fails to comply with paragraph 1 shall be guilty of an offence. Employees with less than two years of service.

For employees are not under the Act retrenchment. 12 months Termination in 2020 and 2021. According to Regulation 6 of the Employment Termination and Lay-Off Benefits Regulations 1980 employees whose monthly salary is RM2000 and below and who falls within the purview of the Employment Act 1955 EA 1955 must be entitled to retrenchment benefits as stated below depending on their tenure of employment-.

More than 5 years. For employees who fall within the Employment Act the length of notice period depends on the. An employee who falls within the scope of the EA is entitled to termination benefits if he has been employed for at least 12 months.

If an employee falls within the Employment Act Employment Termination and Lay-off Benefits Regulations 1990 states they are entitled to lay-off benefits. These are the benefits paid out to employees affected or terminated. According to Department of Labour of Peninsular Malaysia termination of employment means cessation of service due to company closure and workers redundancy.

How To Write An Employment Termination Letter Covid 19 Templates Included Comeet

Retrenchment Compensation Meaning How To Calculate Retrenchment Benefits

What Is Ip Pbx How It Works Benefits Of An Ip Pbx System

Free Termination Letter Make Download Rocket Lawyer

Retrenchment In Malaysia 2021 What It Is Guidelines And Calculations Mednefits

How To Calculate Retrenchment Benefits Hrd Asia

Covid 19 What Is A Lay Off Donovan Ho

What Is An Employer Of Record Definition Benefits Vendor Screening Tips

Service Contract Offer Letter How To Draft A Service Contract Offer Letter Download This Service Contract Offer Lettering Download Letter Example Templates

Employee Benefits Do You Have Any Right To Keep Them Employee Benefits The Guardian

What Is Form Pk L Co Chartered Accountants

Retrenchment In Malaysia 2021 What It Is Guidelines And Calculations Mednefits

Retrenchment In Malaysia 2021 What It Is Guidelines And Calculations Mednefits

5 Reasons Exclusive Property Listing Benefits Sellers Remax Bangkok

10 Tips To Find The Best Lawyer Of These 25 Lawyers Types

Know The Difference Layoff And Retrenchment